UK Corporate Tax Documents translation services are essential for international businesses operating in the UK, as they ensure precise and accurate translations of complex fiscal terminologies and regulations. These specialized services bridge language gaps, navigate legal complexities, and facilitate informed decision-making by providing clear and comprehensible translations to all stakeholders within a company, from executives to auditors. The expertise of these translators in both tax law and multilingual communication is critical for compliance with local UK regulations and for maintaining financial integrity across different linguistic and cultural contexts. By leveraging native speakers with specialized knowledge and adhering to international data protection laws, these translation services enable businesses to accurately convey complex tax information, thereby supporting their strategic goals within the UK marketplace. Accurate translations from these services have proven invaluable for global enterprises, aiding in compliance, risk mitigation, and strategic financial planning in the UK.

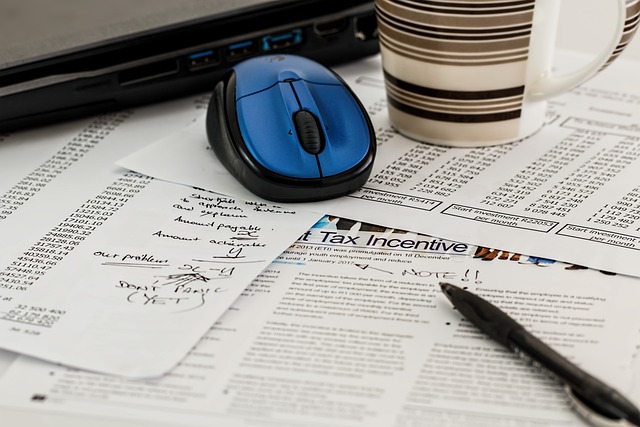

Navigating the intricate maze of international tax laws demands precision and expertise. For businesses with a global footprint, the stakes are high when it comes to accurately translating UK corporate tax documents. This article delves into the nuanced realm of translation services for such critical financial materials. It outlines the complexities businesses face, the importance of meticulous language transfer, and how professional translation services can be instrumental in maintaining compliance across borders. We will explore strategies that ensure tax-related legal texts are effectively translated, guide on selecting a competent UK corporate tax documents translator, and present case studies highlighting successful navigation through this challenging terrain.

- Navigating the Complexities of International Tax Translation

- The Importance of Accurate Translations for UK Corporate Tax Documents

- Overview of UK Corporate Tax Documentation for Foreign Businesses

- Key Challenges in Translating Tax Documents for Multinational Companies

- The Role of Professional Translation Services in Tax Compliance

- Strategies for Effective Translation of Tax-Related Legal Texts

- How to Choose the Right UK Corporate Tax Documents Translation Provider

- Case Studies: Successful Translation of Tax Documentation for Global Enterprises

Navigating the Complexities of International Tax Translation

Navigating the intricate world of international taxation presents significant challenges, particularly for businesses operating across borders. The complexities are amplified when companies must deal with UK Corporate Tax Documents in languages other than their own. Effective communication of tax obligations is critical to ensure compliance and avoid penalties. Here, translation services play a pivotal role, offering precision and clarity that transcends linguistic barriers. These specialized UK Corporate Tax Documents translation services are adept at converting intricate fiscal terminologies and regulations into readily understandable formats for various stakeholders, from executives to auditors. This ensures that all parties involved have an accurate grasp of the tax implications, thereby facilitating informed decision-making and strategic planning. The nuances of tax law vary greatly from one jurisdiction to another, necessitating a deep understanding of both the source and target languages as well as the legal contexts. Consequently, businesses benefit from leveraging expert translation services that specialize in tax documentation to navigate these complexities with confidence and accuracy.

The Importance of Accurate Translations for UK Corporate Tax Documents

Navigating the complexities of UK corporate tax documents requires meticulous attention to detail and a deep understanding of both the source and target languages, as well as the intricacies of tax law. For international businesses, translating these documents accurately is not just a matter of linguistic proficiency but a critical component of compliance and strategic planning. Reliable UK corporate tax documents translation services bridge the gap between multinational corporations and Her Majesty’s Revenue & Customs (HMRC), ensuring that all communications are clear, precise, and legally sound. The precision of these translations is paramount, as errors can lead to misinterpretation of tax obligations, potentially resulting in penalties or legal complications. By leveraging expert translation services, businesses can confidently address their tax liabilities, maintain transparency with regulatory bodies, and manage their financial operations effectively across borders. Accurate translations facilitate a smooth exchange of information and contribute to the establishment of trust between companies and the UK tax authority, thereby fostering an environment conducive to international business growth and success.

Overview of UK Corporate Tax Documentation for Foreign Businesses

When international businesses operate in the UK, navigating the complexities of UK corporate tax documentation becomes imperative. The UK’s Corporate Tax Documents, such as Corporation Tax Returns (CT600), Company Taxation Manuals (CTM), and various forms pertaining to tax computations, withholding taxes, and capital gains tax, are detailed and specific in nature. To ensure compliance and accurate reporting, it is crucial for foreign entities to have these documents translated accurately into their native language. This is where UK Corporate Tax Documents translation services play a pivotal role. These specialized services provide precise translations that facilitate a clear understanding of the tax obligations and rights of the business within the UK’s regulatory framework. By offering multilingual expertise, these services bridge the linguistic gap, enabling businesses to make informed decisions and maintain transparency with stakeholders who may not have proficiency in English. The accuracy of translation is paramount, as misinterpretations or errors could lead to financial repercussions or legal complications for the business. Thus, utilizing professional UK Corporate Tax Documents translation services is an essential step for foreign companies looking to conduct business in the UK with confidence and compliance.

Key Challenges in Translating Tax Documents for Multinational Companies

Navigating the intricacies of tax documentation for multinational companies presents unique challenges, especially when these documents need to be translated accurately and compliantly across different jurisdictions. The complexity of UK Corporate Tax Documents, with their specific legal terminology and regulatory requirements, necessitates a high level of expertise from translation services. Professionals in this field must possess not only linguistic proficiency but also an intimate understanding of tax law to ensure the translated content accurately reflects the original intent and legal implications. The stakes are particularly high given that errors or misinterpretations can lead to significant financial consequences, including penalties and audits. To mitigate these risks, translation services must employ specialized translators with a background in finance and law who are well-versed in the nuances of both the source and target languages. Moreover, leveraging advanced translation technologies and a robust quality assurance process is crucial to guarantee the accuracy and reliability of the translated documents. This is where UK Corporate Tax Documents translation services excel, providing businesses with the confidence that their tax-related communications are handled with the utmost precision and professionalism, thereby facilitating seamless cross-border transactions and compliance.

The Role of Professional Translation Services in Tax Compliance

Navigating the complexities of tax compliance for international businesses often hinges on effective communication across language barriers. In this context, UK Corporate Tax Documents translation services play a pivotal role in ensuring accuracy and compliance with local regulations. Professional translators who specialize in financial and legal documentation are adept at converting intricate tax documents into target languages while maintaining the original intent and nuances. These experts not only possess a deep understanding of both the source and target language but also have a grasp of the specific terminologies used in tax law, which is crucial for avoiding misinterpretations. By providing precise translations, businesses can be confident that their tax submissions are correctly interpreted by local authorities, thus mitigating the risk of non-compliance penalties. Moreover, utilizing specialized translation services for UK Corporate Tax Documents facilitates a smoother dialogue between multinational corporations and their foreign subsidiaries, ensuring seamless cross-border operations and strategic financial planning.

Strategies for Effective Translation of Tax-Related Legal Texts

Navigating the complexities of international business requires a precise and nuanced approach, particularly when it comes to translating UK Corporate Tax Documents. Effective translation services in this domain must transcend mere linguistic equivalence; they must accurately convey the legal intricacies and fiscal regulations inherent within these documents. To achieve this, specialized translation agencies employ multilingual legal experts who are not only proficient in language but also well-versed in tax law and its cross-border implications. These professionals utilize a combination of advanced language technology tools and expert knowledge to ensure that the translated texts maintain their original intent, legal accuracy, and technical precision. By adhering to stringent quality standards, these agencies provide businesses with a reliable means to comply with local regulations, facilitate communication with international tax authorities, and manage their tax obligations across jurisdictions effectively. In doing so, they mitigate the risks associated with misinterpretation or mistranslation of sensitive fiscal information, thereby safeguarding their clients’ financial integrity.

How to Choose the Right UK Corporate Tax Documents Translation Provider

When international businesses navigate the complexities of UK corporate tax documents, selecting a reliable and skilled UK Corporate Tax Documents translation services provider becomes paramount. The accuracy and cultural nuance in translations can significantly impact financial reporting and compliance. It is crucial to opt for a provider with a robust track record in handling sensitive fiscal information, ensuring that the translated content adheres to both the source and target language legal standards. Expertise in UK tax law and multilingual capabilities are essential; the chosen service should employ translators who are not only linguistically adept but also well-versed in accounting terminologies specific to corporate taxation.

Moreover, consider a provider offering UK Corporate Tax Documents translation services that employs native speakers with specialized expertise in the field. These professionals can effectively bridge linguistic and cultural gaps, providing translations that are both precise and idiomatically correct. Additionally, a reputable service will offer confidentiality agreements to safeguard your sensitive data and ensure compliance with international data protection regulations. By prioritizing these aspects, businesses can select a translation provider that not only meets their immediate needs but also supports their long-term strategic objectives in the UK market.

Case Studies: Successful Translation of Tax Documentation for Global Enterprises

Global enterprises frequently encounter the challenge of navigating the complexities of international tax laws, a task that is further compounded by language barriers. To address this, specialized UK Corporate Tax Documents translation services have emerged as invaluable tools for businesses with an international footprint. For instance, a multinational corporation looking to expand its operations in the UK faced the daunting task of understanding and complying with the intricate UK corporate tax regulations. By leveraging professional translation services, they accurately translated all relevant tax documentation into their company’s native language. This allowed for seamless communication between their UK subsidiary and head office, ensuring compliance and avoiding potential legal pitfalls. The accuracy of the translations enabled the corporation to make informed decisions regarding investments, financial planning, and strategic operations within the UK market. Another case study involves a European tech company that required detailed analysis of its UK tax liabilities. With the assistance of UK Corporate Tax Documents translation services, they were able to translate complex tax reports from English to their corporate language. The precise translation facilitated a clear understanding of their fiscal position, leading to effective financial management and strategic decisions that optimized their global operations. These case studies underscore the critical role that expert translation services play in helping international businesses navigate the intricacies of foreign tax systems, thereby mitigating risks and enhancing compliance.

UK corporate tax documents necessitate precise translation to navigate the complexities faced by international businesses. Accuracy in this domain is paramount, as any misstep can lead to significant financial repercussions and legal complications. This article has illuminated the intricacies of translating tax documentation, highlighting the critical role of professional translation services in maintaining compliance across borders. By leveraging specialized expertise and employing strategic approaches to legal text translation, businesses can ensure clarity, legality, and integrity in their international dealings. Choosing the right service provider, as demonstrated through case studies of successful translations for global enterprises, is a strategic advantage that no business should overlook. In conclusion, precise UK corporate tax documents translation services are not just a value-added benefit but an essential tool for today’s multinational corporations.