In today's globalized business environment, navigating complex corporate tax obligations across jurisdictions is paramount for multinational corporations. Accurate UK Corporate Tax Documents preparation and translation are critical to ensure compliance, financial health, and protect against reputational risks. Professional translation services specializing in this area are vital for non-native English speakers, offering expertise in tax terminology, cultural adaptability, and rigorous quality assurance to prevent errors, delays, and legal consequences. Selecting a reputable language service provider with experience in UK Corporate Tax Documents translation is essential for global businesses aiming for seamless compliance and risk mitigation.

In today’s globalized business environment, ensuring global compliance with translated corporate tax filings is paramount. As companies expand internationally, understanding and navigating diverse tax landscapes become essential. This article delves into the intricacies of global corporate tax compliance, highlighting the critical role of accurate translation services in meeting legal obligations. From deciphering complex UK Corporate Tax Documents to choosing reliable language service providers, we explore best practices and future trends shaping this dynamic field.

- Understanding Global Corporate Tax Filing Requirements

- The Role of Accurate Translation in Compliance

- Challenges of International Tax Documentation

- Best Practices for Translating UK Corporate Tax Documents

- Choosing the Right Language Service Provider

- Ensuring Quality and Consistency in Translations

- Legal Implications of Inaccurate Translations

- Future Trends in Global Corporate Tax Compliance

Understanding Global Corporate Tax Filing Requirements

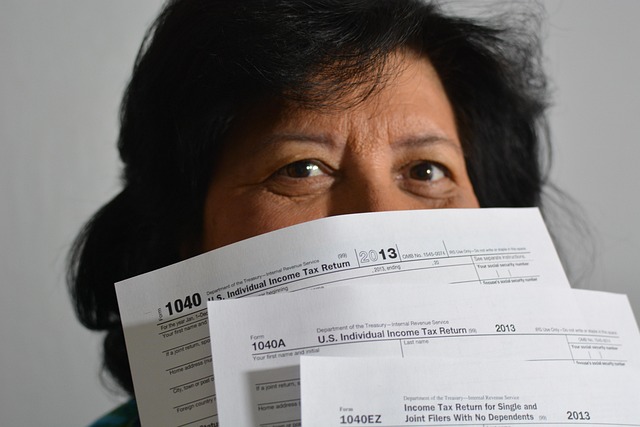

Navigating global corporate tax obligations requires a deep understanding of each country’s unique requirements, especially when it comes to tax documents. For multinational corporations operating across borders, ensuring compliance is not just about meeting legal standards but also maintaining strong financial and reputational integrity. In the UK, for instance, companies must prepare and submit accurate Corporate Tax Documents, which often involve complex regulations related to income, gains, and deductions.

Translated UK Corporate Tax Documents play a vital role in facilitating this process for non-native English speakers. Professional translation services specializing in corporate tax documentation ensure that every term and calculation is accurately conveyed, minimizing the risk of errors or misunderstandings. This is particularly crucial when dealing with international transactions and cross-border activities, where tax laws can vary significantly from one jurisdiction to another.

The Role of Accurate Translation in Compliance

In today’s global business landscape, companies operating internationally must navigate complex regulatory environments to ensure compliance across diverse jurisdictions. One critical aspect often overlooked is the precision and accuracy required in translated corporate tax documents. When it comes to UK Corporate Tax Documents translation services, professionalism and expertise are paramount. A single misinterpretation or error in these filings can lead to significant legal and financial consequences, including penalties, delays, and damage to a company’s reputation.

Accurate translation plays a pivotal role in achieving global compliance. Professional translators with a deep understanding of both the source and target languages, along with tax terminology, are essential. They ensure that corporate tax forms, statements, and associated documentation are not just word-for-word translations but precise representations of the original content. This involves not only translating numbers and legal terms but also adapting to local tax regulations and cultural nuances, thereby safeguarding against potential pitfalls in cross-border transactions.

Challenges of International Tax Documentation

Navigating international tax laws can be a complex and challenging task, especially when it comes to corporate tax filings. Companies operating in multiple jurisdictions face unique hurdles when ensuring compliance with local regulations. One of the primary challenges is understanding and adhering to varying tax requirements across different countries, particularly when it involves translating UK Corporate Tax Documents for international operations. Accurate translation services are crucial to avoid misunderstandings and legal issues.

The process demands precision and a deep grasp of both the source and target languages to convey complex tax concepts accurately. UK-based companies expanding globally need professional translation services that can handle intricate tax terminology and ensure compliance with local tax authorities’ standards. Effective communication and translation of these documents are essential to prevent errors, delays, or penalties in international corporate tax filings.

Best Practices for Translating UK Corporate Tax Documents

When it comes to ensuring global compliance, accurate and reliable translations of UK Corporate Tax Documents are paramount. Businesses operating internationally must navigate complex tax regulations in various jurisdictions, and language barriers can significantly increase this challenge. Engaging professional translation services specialized in UK Corporate Tax Documents is a best practice that offers several key advantages. These experts possess not only deep knowledge of tax terminology but also a strong command of both source and target languages, ensuring precise translations that convey the intended meaning without ambiguity.

Professional translators are adept at handling intricate legal and financial concepts, accounting for any industry-specific jargon or nuanced terms. They also stay up-to-date with changes in UK tax laws and regulations, providing vital contextual understanding to their translations. Furthermore, these services often employ rigorous quality assurance processes, including proofreading and editing by subject matter experts, to guarantee the accuracy and consistency of each translated document. This meticulous approach not only enhances compliance but also promotes efficiency, allowing businesses to meet filing deadlines with confidence in the integrity of their tax submissions across all global markets.

Choosing the Right Language Service Provider

When it comes to global compliance, especially in a complex area like corporate tax filings, selecting the right language service provider (LSP) is paramount. For UK-based companies expanding internationally, choosing a LSP that specialises in corporate tax document translation services can significantly streamline the process. This expertise ensures accuracy, as these providers have in-depth knowledge of both legal and financial terminology, crucial for conveying complex tax information across languages.

Furthermore, a reputable LSP will employ native-speaking translators who understand cultural nuances, ensuring that your UK Corporate Tax Documents are not just translated but also adapted to comply with local regulations. This attention to detail can prevent costly mistakes and potential legal issues in foreign markets, making it an indispensable step in your global compliance strategy.

Ensuring Quality and Consistency in Translations

Ensuring quality and consistency in translations is paramount when navigating the complexities of global compliance, especially for UK Corporate Tax Documents. Professional translation services play a vital role in accurately conveying legal and financial nuances across different languages. These specialized providers employ linguistically trained experts who possess not just proficiency in both source and target languages but also a deep understanding of tax terminology and international regulations.

Consistency is key to maintaining integrity throughout the translation process. Reputable UK Corporate Tax Documents translation services establish rigorous quality assurance protocols, including multiple rounds of review by both translators and editors. This meticulous approach ensures that translations remain faithful to the original content while adhering strictly to grammatical, syntactical, and cultural norms of each target language, thereby facilitating precise global compliance.

Legal Implications of Inaccurate Translations

The accuracy of translated documents is paramount, especially in the complex landscape of global business. When it comes to UK corporate tax filings, inaccurate translations can have severe legal implications. Tax authorities in different jurisdictions often require precise and detailed documentation, and even a minor error in translation could lead to significant consequences. Misinterpretations or oversights may result in audits, penalties, or even legal disputes, particularly when dealing with intricate financial matters.

For companies operating internationally, relying on professional UK Corporate Tax Documents translation services is crucial. These services employ experienced linguists who understand the nuances of tax terminology and local regulations. By ensuring accurate translations, businesses can mitigate risks, avoid costly mistakes, and maintain compliance across all their global operations, thereby fostering a robust and trustworthy financial environment.

Future Trends in Global Corporate Tax Compliance

As the global business landscape continues to evolve, so do the complexities of corporate tax compliance. Future trends in this domain are set to be shaped by several key factors. One notable development is the increased emphasis on digital transformation within tax authorities worldwide. This shift promises faster processing times and more efficient communication between businesses and tax bodies. Automation will play a pivotal role in streamlining various aspects of UK Corporate Tax Documents translation services, ensuring accuracy and consistency across multiple jurisdictions.

Additionally, with cross-border transactions becoming the norm, there’s a growing demand for standardized global tax reporting practices. This trend highlights the need for advanced language solutions to bridge cultural and linguistic gaps. Accurate and timely translations of corporate tax filings will be essential in facilitating smooth interactions between multinational corporations and tax regulators worldwide.

Global corporate tax compliance, especially with translated filings, is a complex yet essential aspect of international business. As companies navigate diverse legal landscapes, accurate translations of UK Corporate Tax Documents play a pivotal role in avoiding legal pitfalls and ensuring adherence to global standards. By implementing best practices, choosing reliable language service providers, and staying informed about future trends, businesses can streamline their tax compliance processes, fostering a robust and legally sound international presence. Effective translation services are not just tools but strategic allies in the global business arena.